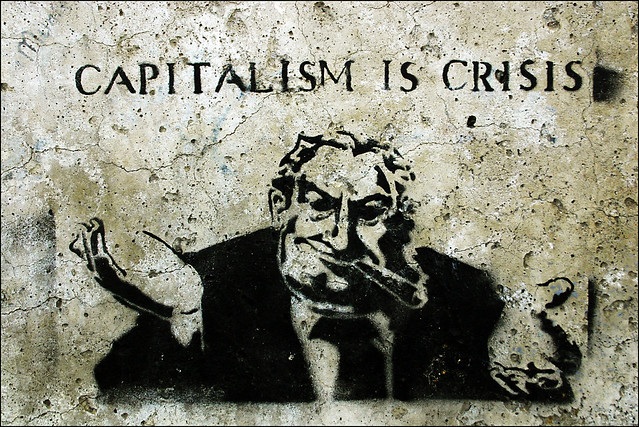

Image by Michael Coghlan via Flickr

by Michael Hudson

Writer, Dandelion Salad

December 6, 2022

Questions from Almayadeen TV, Lebanon by Mohammad Itmaizeh

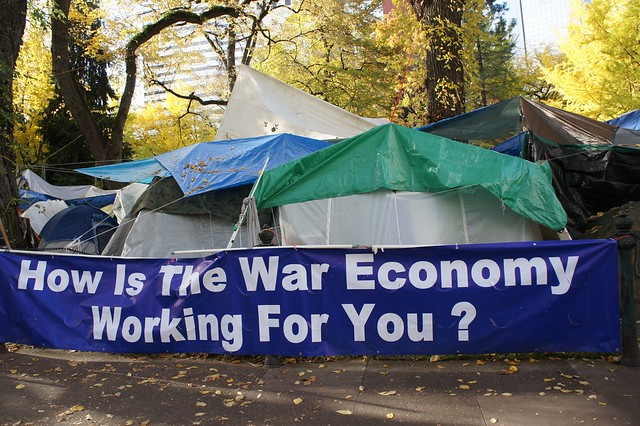

1: In light of the conditions that Europe is experiencing, in terms of high energy prices and the repercussions on the industrial sector, like the closure of factories and the high cost of production. In your opinion do European countries have the capacity and resources to prevent industrial investments from “escaping”? Especially since the US plans in general to restore industry to its lands, thus, it may represent an opportunity to lure European industries to move to there and take advantage of cheap energy prices. This shift will have wide repercussions on Europe’s productive capacities and competitiveness, as well as on its trade balance. So, what happens to the position of Europe in the global economic system? Will it remain part of the capitalist center or deviate from it?

Continue reading →